Exchange rate prediction is a crucial aspect of international finance, impacting decisions by governments, investors, and businesses. Accurate prediction supports the development of sound monetary policies, effective risk management, and strategic international trade planning. According to literature, traditional econometric models like ARIMAX and VAR often struggle to capture the complex, non-linear dynamics of foreign exchange markets. In contrast, machine learning methods, particularly Extreme Gradient Boosting (XGBoost), have shown superior performance due to their ability to handle large datasets, model non-linear relationships, and resist overfitting. This study evaluates the efficacy of the Extreme Gradient Boosting (XGBoost) model by predicting the GHc/USD, GHc/GBP and GHc/EUR exchange rates. Four different types of XGBoost models were employed on the financial data to determine the best performed model. The four different XGBoost models include, the XGBoost all feature, the XGBoost difference feature, the XGBoost ratio feature and the XGBoost lagged feature. The data sourced from Bank of Ghana and World Bank websites spans from January 2015 to March 2025. Findings from the study reveals that the XGBoost lagged feature and XGBoost all feature models outperformed the other two models, with an average R2of 99%, RMSE of 0.05, and MAE of 0.01. Gold price was the biggest contributor to the GHc/USD exchange rate with the feature important score of 80% followed by monthly interest rate 60%, Government debt 25%, M2 20%, price of oil 20%, BCI 15%, and CCI 10%. This result provides valuable insight for financial analyst and policymakers seeking to forecast/predict exchange rates and develop policies aimed at addressing exchange rate menace in Ghana.

| Published in | International Journal of Economics, Finance and Management Sciences (Volume 13, Issue 5) |

| DOI | 10.11648/j.ijefm.20251305.13 |

| Page(s) | 260-270 |

| Creative Commons |

This is an Open Access article, distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution and reproduction in any medium or format, provided the original work is properly cited. |

| Copyright |

Copyright © The Author(s), 2025. Published by Science Publishing Group |

XGBoost, All Features, Difference Features, Ratio Features, Lagged Features, Exchange Rate, Hyperparameter Tuning, Regularization Parameter

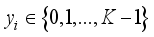

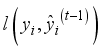

is the feature vector and

is the feature vector and  or

or  is the target label for regression or classification.

is the target label for regression or classification.  (1)

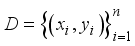

(1)  (2)

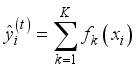

(2)  is the predicted exchange rate at time

is the predicted exchange rate at time  ,

,  is the vector of dimension

is the vector of dimension  of macroeconomic and financial features observed at time

of macroeconomic and financial features observed at time  , and

, and  is the nonlinear mapping learned by the XGBoost algorithm.

is the nonlinear mapping learned by the XGBoost algorithm.  , the additive model for the XGBoost is given by equation (3), where

, the additive model for the XGBoost is given by equation (3), where  is the regression tree (decision tree) and

is the regression tree (decision tree) and  is the space of all regression trees.

is the space of all regression trees.  (3)

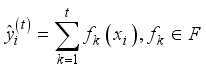

(3)  that minimizes the regularized loss function in equation (4).

that minimizes the regularized loss function in equation (4).  (4)

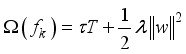

(4)  is the prediction function,

is the prediction function,  is the loss function,

is the loss function,  is the regularization for tree

is the regularization for tree  ,

,  is the number of boosting iteration,

is the number of boosting iteration,  is the number of leaves in each tree,

is the number of leaves in each tree,  is the leaf weights, and

is the leaf weights, and  is the regularization parameters.

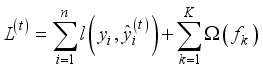

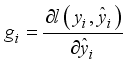

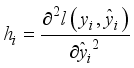

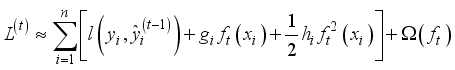

is the regularization parameters.  , XGBoost uses a second-order Taylor expansion of the loss function which is indicated by equation (5), where

, XGBoost uses a second-order Taylor expansion of the loss function which is indicated by equation (5), where  is the first-order gradient and

is the first-order gradient and  is the second-order gradient often referred to as Hessian.

is the second-order gradient often referred to as Hessian.  (5)

(5)  is dropped in optimization.

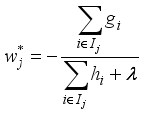

is dropped in optimization.  leaves. Let

leaves. Let  denote the instance set of leaf

denote the instance set of leaf  , the optimal weight

, the optimal weight  for leaf

for leaf  is given by equation (6).

is given by equation (6).  (6)

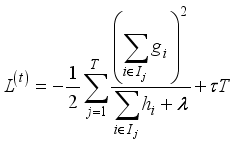

(6)  becomes equation (7). This score is used to determine the best tree structure (i.e., how to split the nodes).

becomes equation (7). This score is used to determine the best tree structure (i.e., how to split the nodes).  (7)

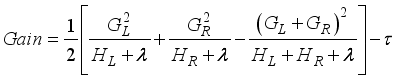

(7)  is the sum of gradients and Hessians for left split and

is the sum of gradients and Hessians for left split and  is the sum of gradients and Hessians for right split.

is the sum of gradients and Hessians for right split.  (8)

(8)

) Score which are indicated in equation (s) (9), (10), and (11).

) Score which are indicated in equation (s) (9), (10), and (11).  (9)

(9)  (10)

(10)  (11)

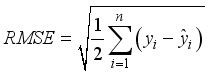

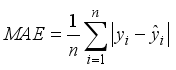

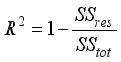

(11)  value of 34.48%. This low

value of 34.48%. This low  value indicates the model poor performance, failing to capture to capture the underlying dynamics of GHc/USD fluctuations. This is due to lower dimensionality of the features set. Also, the model’s inability to effectively process high volatility features results in poor predictive performance. The XGBoost ratio features model did not perform any better than that of the difference features, although it was able to reduce the RMSE and MAE values significantly. The XGBoost all features model on the other hand, performs significantly better with an RMSE of 0.0065, MAE of 0.0045, and an

value indicates the model poor performance, failing to capture to capture the underlying dynamics of GHc/USD fluctuations. This is due to lower dimensionality of the features set. Also, the model’s inability to effectively process high volatility features results in poor predictive performance. The XGBoost ratio features model did not perform any better than that of the difference features, although it was able to reduce the RMSE and MAE values significantly. The XGBoost all features model on the other hand, performs significantly better with an RMSE of 0.0065, MAE of 0.0045, and an  value of 96.46%. This indicates very good predictive performance and a better handling of the feature sets compared to difference and ratio features. All features ability to use the features raw dimensionality, coupled with better boosting and regularization techniques helps capture the relevant patterns in the data, leading to batter prediction accuracy. However, if compared to XGBoost lagged features model, there is still room for improvement, as indicated by the RMSE and MAE values. The XGBoost lagged features model outperformed all the other models with the lowest RMSE of 0.0005, MAE of 0.0001 and the highest

value of 96.46%. This indicates very good predictive performance and a better handling of the feature sets compared to difference and ratio features. All features ability to use the features raw dimensionality, coupled with better boosting and regularization techniques helps capture the relevant patterns in the data, leading to batter prediction accuracy. However, if compared to XGBoost lagged features model, there is still room for improvement, as indicated by the RMSE and MAE values. The XGBoost lagged features model outperformed all the other models with the lowest RMSE of 0.0005, MAE of 0.0001 and the highest  of 99.99%. Lagged features architecture, which predict the GHc/USD using the previous feature sets was very effective and rightly so, because most macroeconomic, financial, and commodity price features predict better using their past features.

of 99.99%. Lagged features architecture, which predict the GHc/USD using the previous feature sets was very effective and rightly so, because most macroeconomic, financial, and commodity price features predict better using their past features. Exchange Rate | Model | RMSE | MAE | R-Square |

|---|---|---|---|---|

GHc/USD | XGBoost All Features | 0.0065 | 0.0045 | 0.9646 |

XGBoost Difference Features | 5.4345 | 2.3525 | 0.3448 | |

XGBoost Ratio Features | 0.8759 | 0.2510 | 0.3890 | |

XGBoost Lagged Features | 0.0005 | 0.0001 | 0.9999 | |

GHc/GBP | XGBoost All Features | 0.0917 | 0.0687 | 0.9995 |

XGBoost Difference Features | 0.6592 | 0.3341 | 0.2980 | |

XGBoost Ratio Features | 0.0321 | 0.0220 | 0.2973 | |

XGBoost Lagged Features | 0.0010 | 0.0008 | 0.9999 | |

GHc/EUR | XGBoost All Features | 0.0067 | 0.0046 | 0.9651 |

XGBoost Difference Features | 5.0159 | 2.2638 | 0.4000 | |

XGBoost Ratio Features | 0.3024 | 0.1888 | 0.3408 | |

XGBoost Lagged Features | 0.0066 | 0.0047 | 0.9658 |

value of 99.99%, 99.99%, and 96.58% respectively. This emphasizes XGBoost lagged features model’s efficiency and effectiveness, in contrast, the XGBoost difference features model performs poorly, particularly with periods of extreme volatility.

value of 99.99%, 99.99%, and 96.58% respectively. This emphasizes XGBoost lagged features model’s efficiency and effectiveness, in contrast, the XGBoost difference features model performs poorly, particularly with periods of extreme volatility. GDP | Gross Domestic Product |

XGBoost | Extreme Gradient Boost |

BCI | Business Confidence Index |

CCI | Consumer Confidence Index |

| [1] | Shen, M. L., Lee, C. F., Liu, H. H., Chang, P. Y. and Yang, C. H. (2021), “An Effective Hybrid Approach for Forecasting Currency Exchange Rates”, Sustainability, Vol. 13, No. 5, pp. 27-61. |

| [2] | García, F., Guijarro, F., Oliver, J. and Tamošiūnienė, R. (2023), “Foreign Exchange Forecasting Models: ARIMA and LSTM Comparison”, Engineering Proceedings, Vol. 39, No. 1, 81 pp. |

| [3] | Hernes, M., Adaszynski, J. and Tutak, P. (2023), “Credit Risk Modeling Using Interpreted XGBoost”, European Management Studies, Vol. 21, No. 101, pp. 46-70. |

| [4] | Zubairu, I., Alenezi, M., Iddrisu, A. J. and Dawson, S. (2024), “The Dynamics of the Ghanaian Currency Depreciation: A Case Analysis of the Performance of Ghana Cedi (GHC) Against Its Major Trading Currencies”, International Journal of Economics, Finance and Management Sciences, Vol. 12, No. 1, pp. 18-43. |

| [5] | Quaicoe, M. T., Twenefour, F. B. K., Baah, E. M. and Nortey, E. N. N. (2015), “Modeling Variations in the Cedi/Dollar Exchange Rate in Ghana: An Autoregressive Conditional Heteroscedastic (ARCH) Models”, SpringerPlus, Vol. 4, 86 pp. |

| [6] | Islam, S. F. N., Sholahuddin, A. and Abdullah, A. S. (2021), “Extreme Gradient Boosting (XGBoost) Method in Making Forecasting Application and Analysis of USD Exchange Rates against Rupiah”, Journal of Physics: Conference Series, Vol. 1722, No. 1, pp. 012-016. |

| [7] | Ullah, I., Huang, Z., Rehman, D. and Khan, S. (2024), “Forecasting Foreign Exchange Rate with Machine Learning Techniques: Chinese Yuan to US Dollar Using XGBoost and LSTM Model”, iRASD Journal of Economics, Vol. 6, No. 1, pp. 1-10. |

| [8] | Gbadebo, A. D. (2025), “Leveraging Machine Learning for Exchange Rate Prediction: A Business and Financial Management Perspective in Nigeria”, Reviews of Management Sciences, Vol. 6, No. 2, pp. 36-52. |

| [9] | Pirayesh Neghab, D., Cevik, M. and Wahab, M. I. M. (2024), “Explaining Exchange Rate Forecasts with Macroeconomic Fundamentals Using Interpretive Machine Learning”, Computational Economics, Vol. 65, pp. 1857–1899. |

| [10] | Ibhagui, O. W. and Babajide, A. A. (2020), “Macroeconomic Indicators and Capital Market Performance: Are the Links Sustainable?”, Cogent Economics & Finance, Vol. 8, No. 1, 17 pp. |

| [11] | Adusei, M. and Gyapong, E. Y. (2017), “The Impact of Macroeconomic Variables on Exchange Rate Volatility in Ghana: The Partial Least Squares Structural Equation Modelling Approach”, Research in International Business and Finance, Vol. 42, pp. 1428-1444. |

| [12] | Iqbal, F., Koutmos, D., Ahmed, E. A. and Al-Essa, L. M. (2024), “A novel hybrid deep learning method for accurate exchange rate prediction. Risks”, Vol. 12, No. 9, 139 pp. |

| [13] | Neghab, D. P., Cevik, M., Wahab, M. I. M. and Basar, A. (2024), “Explaining Exchange Rate Forecasts with Macroeconomic Fundamentals using Interpretive Machine Learning”, Computational Economics, pp. 1-43. |

| [14] | Türkoğlu, F., Göçecek, E. and Yumrukuz, Y. (2024), “Predictive Abilities of Machine Learning and Deep Learning Approaches for Exchange Rate Prediction”, BDDK Bankacılık ve Finansal Piyasalar Dergisi, Vol. 18, No. 2, pp. 186-210. |

| [15] | Petropoulos, A. and Siakoulis, V. (2021), “Can Central Bank Speeches Predict Financial Market Turbulence? Evidence from an Adaptive NLP Sentiment Index Analysis using XGBoost Machine Learning Technique”, Central Bank Review, Vol. 21, No. 4, pp. 141-153. |

| [16] | Acquah, J., Nti, A. E., Ampofi, I. and Akorli, D. (2022), “Artificial Neural Network Model for Predicting Exchange Rate in Ghana: A Case of GHS/USD”, American Journal of Mathematical and Computer Modelling, Vol. 7, No. 1, pp. 1-11. |

| [17] | Ameyaw, E. (2023), “The Relevance of Domestic and Foreign Factors in Driving Ghana’s Business Cycle”, SN Business & Economics, Vol. 3, No. 9, 33 pp. |

| [18] | Ben Jabeur, S., Mefteh-Wali, S. and Viviani, J. L. (2024), “Forecasting Gold Price with the XGBoost Algorithm and SHAP Interaction Values”, Annals of Operations Research, Vol. 334, No. 1, pp. 679-699. |

| [19] | Chen, T. and Guestrin, C. (2016), “XGBoost: A Scalable Tree Boosting System”, Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, pp. 785-794. |

| [20] | Meng, Y., Yang, N., Qian, Z. and Zhang, G. (2020), “What Makes an Online Review more Helpful: An Interpretation Framework using XGBoost and SHAP Values”, Journal of Theoretical and Applied Electronic Commerce Research, Vol. 16, No. 3, pp. 466-490. |

APA Style

Ampofi, I., Brew, L., Wiah, E. N. (2025). Experimental XGBoost Method for Predicting the Ghana Cedi Exchange Rate Against Major Developed Currencies. International Journal of Economics, Finance and Management Sciences, 13(5), 260-270. https://doi.org/10.11648/j.ijefm.20251305.13

ACS Style

Ampofi, I.; Brew, L.; Wiah, E. N. Experimental XGBoost Method for Predicting the Ghana Cedi Exchange Rate Against Major Developed Currencies. Int. J. Econ. Finance Manag. Sci. 2025, 13(5), 260-270. doi: 10.11648/j.ijefm.20251305.13

AMA Style

Ampofi I, Brew L, Wiah EN. Experimental XGBoost Method for Predicting the Ghana Cedi Exchange Rate Against Major Developed Currencies. Int J Econ Finance Manag Sci. 2025;13(5):260-270. doi: 10.11648/j.ijefm.20251305.13

@article{10.11648/j.ijefm.20251305.13,

author = {Isaac Ampofi and Lewis Brew and Eric Neebo Wiah},

title = {Experimental XGBoost Method for Predicting the Ghana Cedi Exchange Rate Against Major Developed Currencies

},

journal = {International Journal of Economics, Finance and Management Sciences},

volume = {13},

number = {5},

pages = {260-270},

doi = {10.11648/j.ijefm.20251305.13},

url = {https://doi.org/10.11648/j.ijefm.20251305.13},

eprint = {https://article.sciencepublishinggroup.com/pdf/10.11648.j.ijefm.20251305.13},

abstract = {Exchange rate prediction is a crucial aspect of international finance, impacting decisions by governments, investors, and businesses. Accurate prediction supports the development of sound monetary policies, effective risk management, and strategic international trade planning. According to literature, traditional econometric models like ARIMAX and VAR often struggle to capture the complex, non-linear dynamics of foreign exchange markets. In contrast, machine learning methods, particularly Extreme Gradient Boosting (XGBoost), have shown superior performance due to their ability to handle large datasets, model non-linear relationships, and resist overfitting. This study evaluates the efficacy of the Extreme Gradient Boosting (XGBoost) model by predicting the GHc/USD, GHc/GBP and GHc/EUR exchange rates. Four different types of XGBoost models were employed on the financial data to determine the best performed model. The four different XGBoost models include, the XGBoost all feature, the XGBoost difference feature, the XGBoost ratio feature and the XGBoost lagged feature. The data sourced from Bank of Ghana and World Bank websites spans from January 2015 to March 2025. Findings from the study reveals that the XGBoost lagged feature and XGBoost all feature models outperformed the other two models, with an average R2of 99%, RMSE of 0.05, and MAE of 0.01. Gold price was the biggest contributor to the GHc/USD exchange rate with the feature important score of 80% followed by monthly interest rate 60%, Government debt 25%, M2 20%, price of oil 20%, BCI 15%, and CCI 10%. This result provides valuable insight for financial analyst and policymakers seeking to forecast/predict exchange rates and develop policies aimed at addressing exchange rate menace in Ghana.

},

year = {2025}

}

TY - JOUR T1 - Experimental XGBoost Method for Predicting the Ghana Cedi Exchange Rate Against Major Developed Currencies AU - Isaac Ampofi AU - Lewis Brew AU - Eric Neebo Wiah Y1 - 2025/09/19 PY - 2025 N1 - https://doi.org/10.11648/j.ijefm.20251305.13 DO - 10.11648/j.ijefm.20251305.13 T2 - International Journal of Economics, Finance and Management Sciences JF - International Journal of Economics, Finance and Management Sciences JO - International Journal of Economics, Finance and Management Sciences SP - 260 EP - 270 PB - Science Publishing Group SN - 2326-9561 UR - https://doi.org/10.11648/j.ijefm.20251305.13 AB - Exchange rate prediction is a crucial aspect of international finance, impacting decisions by governments, investors, and businesses. Accurate prediction supports the development of sound monetary policies, effective risk management, and strategic international trade planning. According to literature, traditional econometric models like ARIMAX and VAR often struggle to capture the complex, non-linear dynamics of foreign exchange markets. In contrast, machine learning methods, particularly Extreme Gradient Boosting (XGBoost), have shown superior performance due to their ability to handle large datasets, model non-linear relationships, and resist overfitting. This study evaluates the efficacy of the Extreme Gradient Boosting (XGBoost) model by predicting the GHc/USD, GHc/GBP and GHc/EUR exchange rates. Four different types of XGBoost models were employed on the financial data to determine the best performed model. The four different XGBoost models include, the XGBoost all feature, the XGBoost difference feature, the XGBoost ratio feature and the XGBoost lagged feature. The data sourced from Bank of Ghana and World Bank websites spans from January 2015 to March 2025. Findings from the study reveals that the XGBoost lagged feature and XGBoost all feature models outperformed the other two models, with an average R2of 99%, RMSE of 0.05, and MAE of 0.01. Gold price was the biggest contributor to the GHc/USD exchange rate with the feature important score of 80% followed by monthly interest rate 60%, Government debt 25%, M2 20%, price of oil 20%, BCI 15%, and CCI 10%. This result provides valuable insight for financial analyst and policymakers seeking to forecast/predict exchange rates and develop policies aimed at addressing exchange rate menace in Ghana. VL - 13 IS - 5 ER -